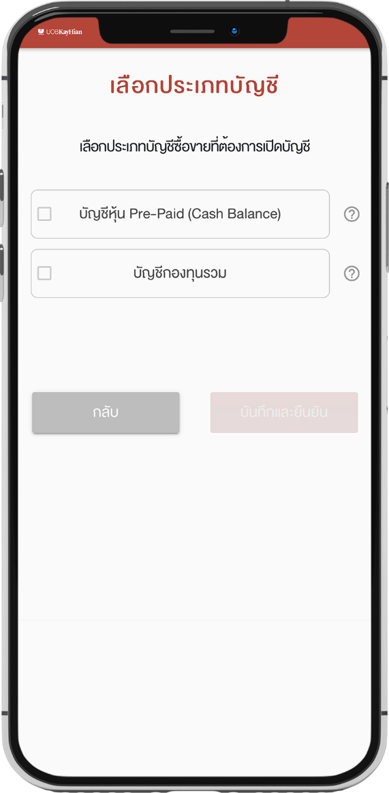

Cash Balance Account (Pre-paid Account) - Require to deposit at full amount as collateral 100% in cash, prior to trading. The initial credit limit is 500,000 baht.

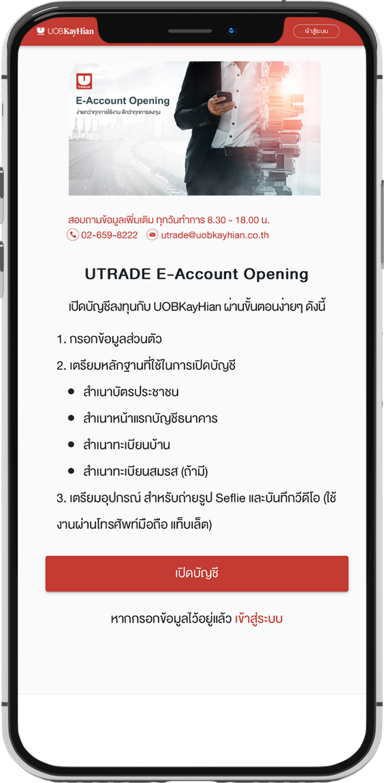

3 Steps to Open an Online Account

1

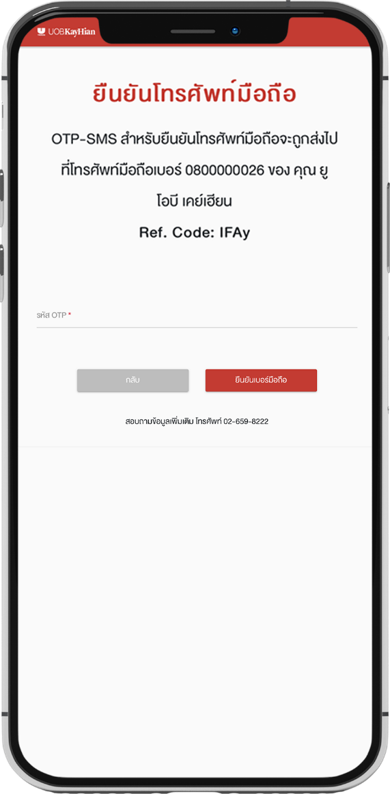

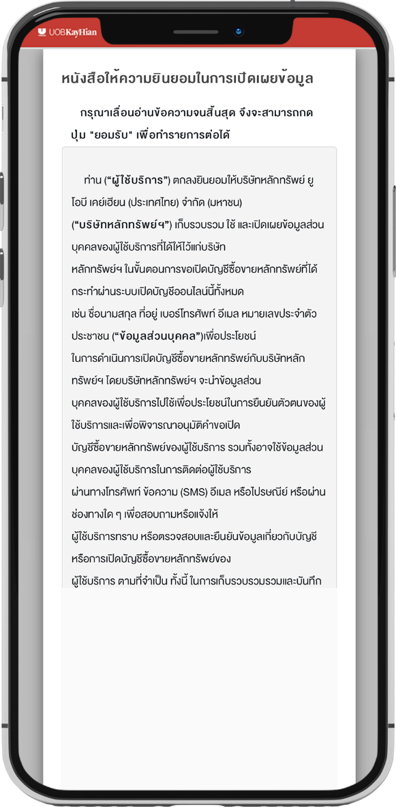

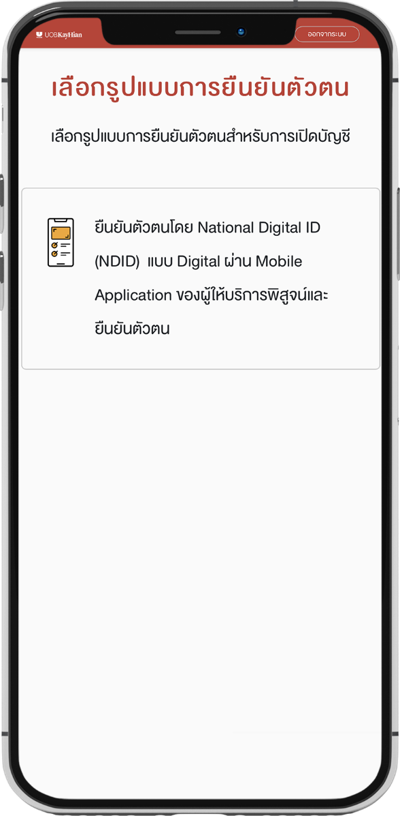

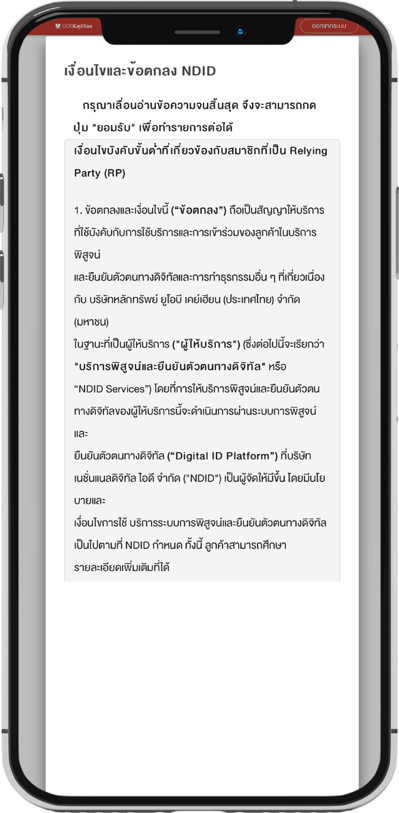

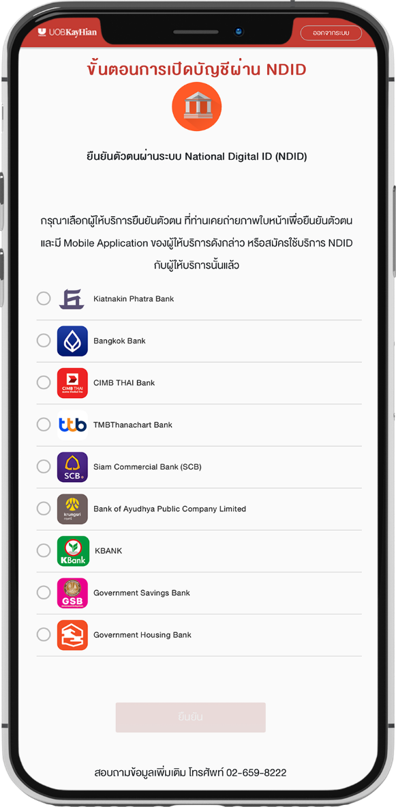

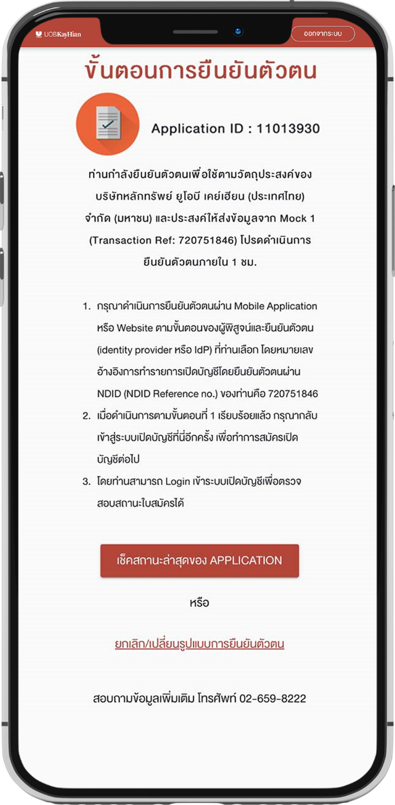

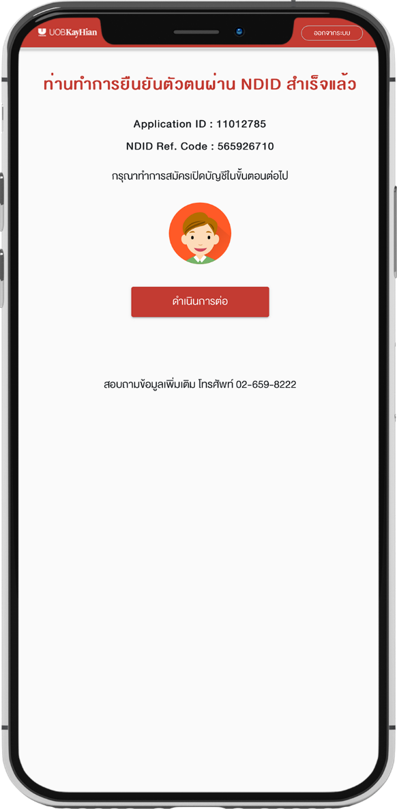

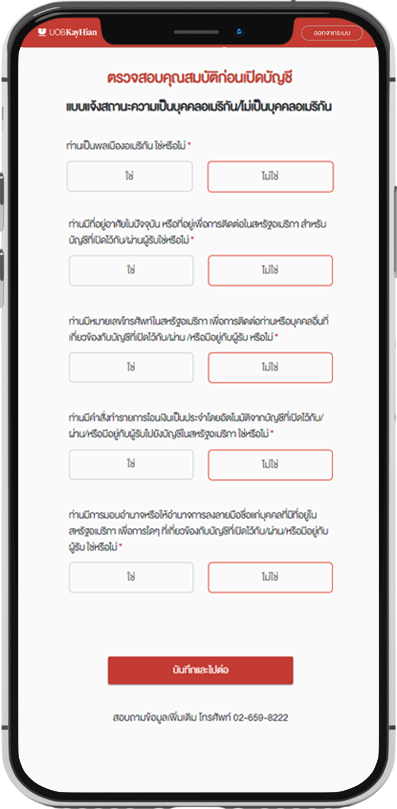

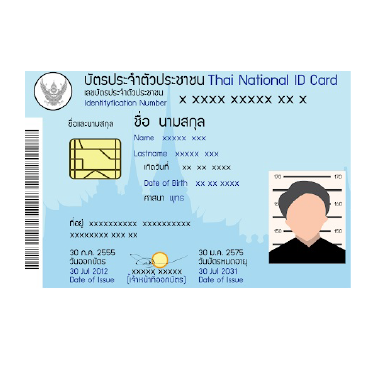

Customers need to do a dip chip or bring their ID card to a bank branch or ATM and apply for the NDID service to verify their identity through a Mobile Bank App.

1.1 ) Bring your ID card to the ATM. Currently, ATMs that support identity verification are only Kasikorn ATMs.

1.2) Verify your identity through applying for NDID with the bank that opened the savings account.

2

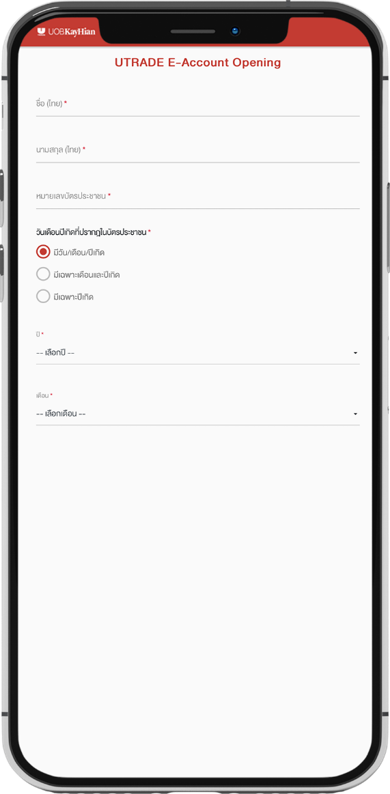

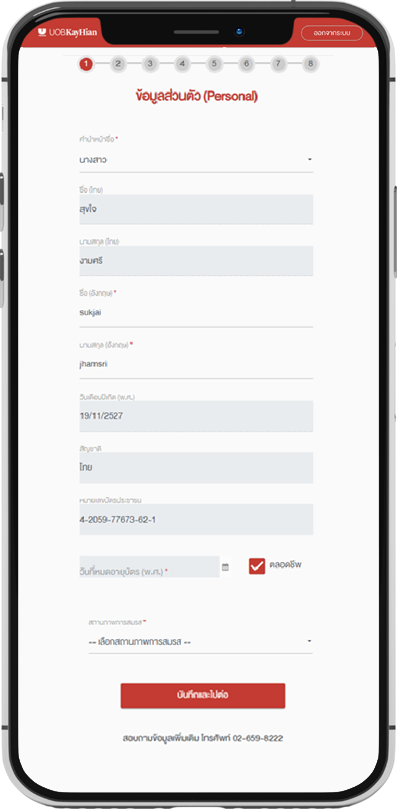

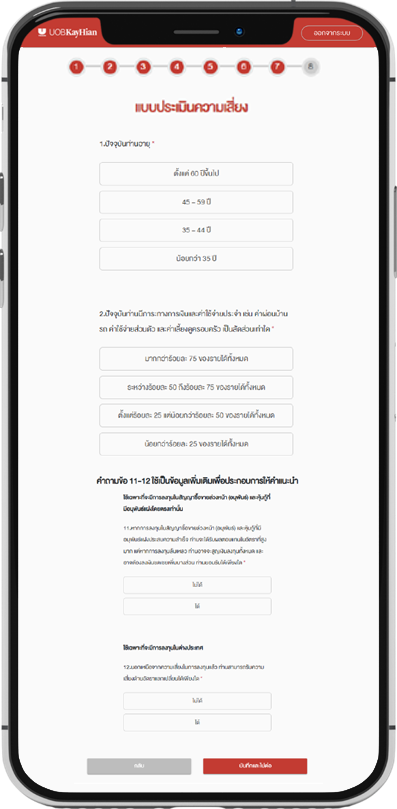

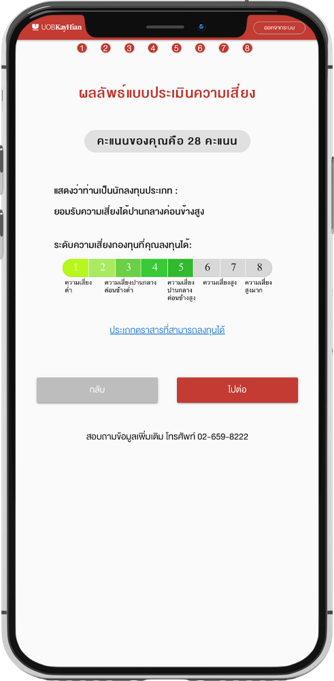

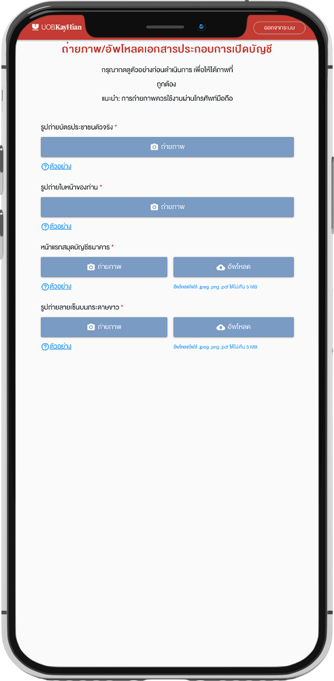

Fill out the information to open an online account, prepare documents and photos.

Note:4 Things to take during the photoshoot process (1.) Take a photo of your ID card

3

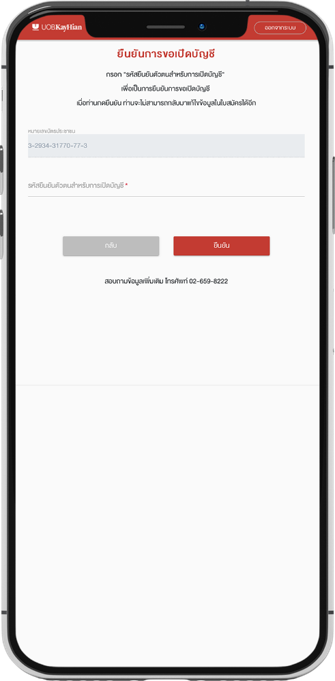

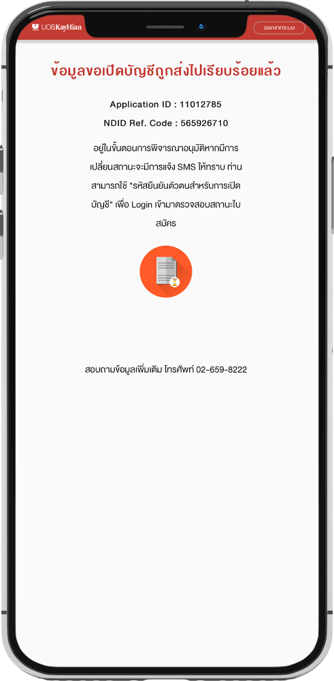

Wait for the approval result to open an account via Email,

then press register to verify your identity before using online for the first time

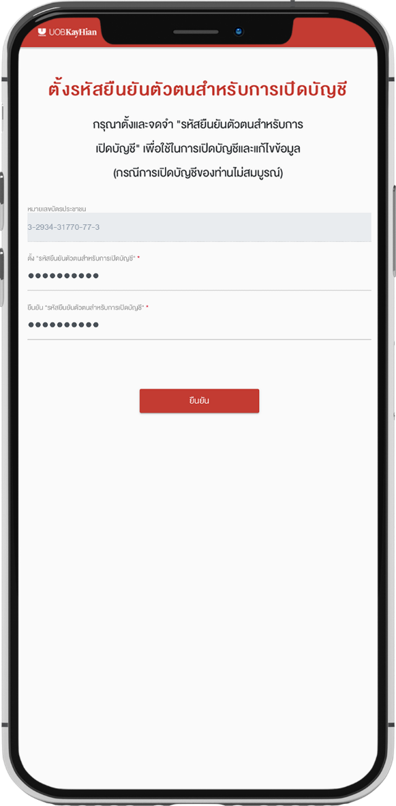

Fill in the Username and Registration Code received via email

Fill in your 13-digit ID card number with your date of birth information, then press the Submit button

Reset password to access numbers and English letters 6-10 digits

Set Pin no. which consists of 6 digits, then press Confirm to use immediately

1

Choose a trading account type.

Documents for opening an account

A copy of ID card

A copy of house registration

A copy of the first page of the passbook

Stamp duty fee 30 baht

For Cash Account, please attach 1 copy of the bank account for the past 3 months

2

Submit documents to UOB Kay Hian Securities Public Company Limited (Head Office), E-Business Department, No. 130-132 Sindhorn Tower 1, 3rd Floor, Wireless Road, Lumpini Subdistrict, Pathumwan District, Bangkok 10330 or use messenger service of UOBKayHian Securities.

3

Wait for the approval result to open an account via Email,

then press register to verify your identity before using online for the first time

Fill in the Username and Registration Code received via email

Fill in your 13-digit ID card number with your date of birth information, then press the Submit button

Reset password to access numbers and English letters 6-10 digits

Set Pin no. which consists of 6 digits, then press Confirm to use immediately

With rapid technological advancements, our company has been dedicated in providing various investment alternatives in satisfying our clients' needs through trading online and via smartphones and tablets in real time. Our clients can trade equities and derivatives online at www.utrade.co.th quickly and easily at anytime of the day. With real-time streaming, customers can access the trading system from anywhere in the world immediately via your smartphone or tablet operating on the iOS or Android operating system with lower commission rates compared to broker-assisted trading.

1. Streaming New

2. iFIS X

UOBKH also provides our clients exclusively with technical and fundamental analyses by our professional analysts.

Customers can trade directly via the two programs below:

Furthermore, our customers can access further information via www.efinancethai.com for free!

Types of Securities Trading Accounts

There are 4 types of trading accounts, as follows:

1.Cash Account allows investors to purchase shares within a credit limit given by UOBKH. The credit limit is determined by the investors’ credit standing. Investors are required to deposit 20% worth of collateral (cash or securities) to UOBKH prior to trading. The settlement date is 3 working days (T+3) after the trading date.

2.Cash Balance Account is a trading account in which investors are required to deposit the full amount as collateral (100%), in cash, prior to trading. There is no determination of credit limit for this type of trading account; the amount available for trading depends on the amount deposited by the investors. Cash deposited will receive interest at a rate announced by UOBKH and interest is calculated daily based on the investors’ outstanding balance. However, this type of trading account will see immediate deduction or addition to the trading account balance when selling or buying shares, respectively. In the event that you wish to withdraw cash from your trading account(s), you will need to fill in the Money Withdrawal form and send the form to your marketing officer before 11.00 AM. The money will be transferred to your preferred bank account indicated on the Money Withdrawal form, effective on the next working day. (UOBKH will consider whether the amount requested to be withdrawn by you can be withdrawn in full. This consideration depends on whether the securities bought have been paid for (deducted from the cash balance) i.e. whether T+3 has lapsed. For example, if the amount you wish to withdraw results in the cash balance remaining in the trading account to be unable to fulfill the outstanding payments due on T+3, UOBKH will not be able to transfer the full amount to you)

3.Credit Balance Account or Margin Loan Account is a trading account in which cash is loaned from the broker in the buying of securities. The amount that can be loaned is subjected to a credit limit determined by the proportion loanable of each security. Investors have to deposit cash and/or mortgage securities as collateral with a minimum value equal to the Initial Margin (IM) determined by UOBKH. Cash deposited as collateral in excess of the loaned amount will receive interest at a rate announced by UOBKH. While interest has to be paid if the cash deposited is less than the loaned amount.

4.Derivatives Trading Account is used in the trading of futures in the TFEX market. Investors have to deposit cash as collateral according to the official rate determined by the FI club before every trade. This type of trading account is similar to the cash balance trading account in which the amount available to the investors for trading depends on the amount deposited by the investors.

Sliding commission rates for stock trading via an investment consultant (by call) and online trading channel.

| Trading Value per Day (X Baht) | Trade via Investment Consultant | Trade via Internet Channel | |

|---|---|---|---|

| Cash Account | Cash Balance Account (Pre-paid Account ) |

||

| X < 5 MB | 0.257% | 0.207% | 0.157% |

| 5 MB < X < 10 MB | 0.227% | 0.187% | 0.137% |

| 10 MB < X < 20 MB | 0.187% | 0.157% | 0.117% |

| X > 20 MB | 0.157% | 0.127% | 0.107% |

There are 3 additional charging fees applied to all trading of securities listed by SET and MAI as the following:

1. Trading Fees: the company will charge for SET. At a rate of 0.005% value per day

2. Clearing Fees: the company will charge for TSD. At a rate of 0.001% value per day

3. The Regulatory Fees: At a rate of 0.001% value per day

**Remark:

1. Incase no trading or no match for your trading, there will not be any charge for that day.